This replay is reserved exclusively for community bankers.

Enter your bank email address to gain access.

In this exclusive session, Beth Beale, EVP, CFO of Benchmark Community Bank, illustrates how KlariVis has transformed the daily workflow across every department of her bank. From monitoring liquidity in real time to making quick, informed pricing decisions, Beth shares exactly how she and her team have leveraged KlariVis to eliminate manual reporting and improve profitability.

Hosted by Kim Snyder, CEO & Founder of KlariVis, this walkthrough takes you inside a CFO’s day - where access to data-driven insights has become undeniably critical.

“The person in our organization who is the most excited about KlariVis, and has said, ‘this is the best thing the bank’s done since I’ve been here,’ is Benchmark’s top commercial lender.”

“Instead of coming out of that meeting with everybody having a to-do list to go dig and drill and put together information and then come back together… we were able to table that right then and say...

okay, that is a portfolio risk larger than we anticipated.”

“We have been able to expand our margin almost 40 basis points using KlariVis to inform our decision-making.”

What you’ll learn from Beth’s walkthrough:

- How KlariVis helped Benchmark expand margin by nearly 40 basis points

- Why a “single version of the truth” replaced thousands of redundant reports.

- How daily insights into loans, deposits, and rates drive smarter pricing and structure decisions.

- Practical rollout lessons for engaging teams across retail, commercial, and executive management.

.png?width=2000&height=83&name=Boxes_Color%20(1).png)

ABOUT KLARIVIS

As former bank leaders, we completely understand what insights you need to see and the highly-specific way you want to see them.

We also have the expertise needed to build a unique platform that community bankers across the nation could use to transform their organization.

So, we did.

KlariVis aggregates your bank's high-value, actionable data into one user-friendly platform.

INTERACTIVE DASHBOARDS

Ditch boring reports, bring your data to life

Empower your team to make informed decisions with self-service access to our 650+ interactive and static dashboards. Say goodbye to complicated reporting processes and hello to actually leveraging the insights within your data.

CUSTOMER-LEVEL DRILL DOWNS

From big picture to transaction level data

Quickly drill down from a macro view all the way to the customer level directly from your interactive dashboard. Instead of sifting through countless reports and making numerous phone calls, spend that valuable time taking action on the data rather than hunting for it.

ENTERPRISE ACCESS

Accurate, centralized data at your fingertips

Gain insights into every aspect of your business, from lending and retail to finance and operations. With enterprise access, you can ensure that everyone in your organization is on the same page with consistent data that can be used to make informed decisions and achieve your bank's goals.

SECURITY FIRST

KlariVis is a security-first organization

The security of your customers' data is a top priority. As former bank leaders, we know what is needed to satisfy regulatory and security concerns. KlariVis maintains robust internal controls based upon strict information security policies and procedures developed and implemented to protect our clients’ data.

+ SO MUCH MORE

Schedule a 1:1 meeting with our team to learn why KlariVis is the data analytics platform preferred by community banks nationwide!

.png?width=2000&height=83&name=Boxes_Color%20(1).png)

The Truth About Data Quality in Banks: Tools Can’t Fix What People Don’t Own

A robust data platform can transform your bank’s data quality with one specific stipulation: It must be paired with the right top-down approach that encourages and empowers every banker to own the data they use.

Read Now

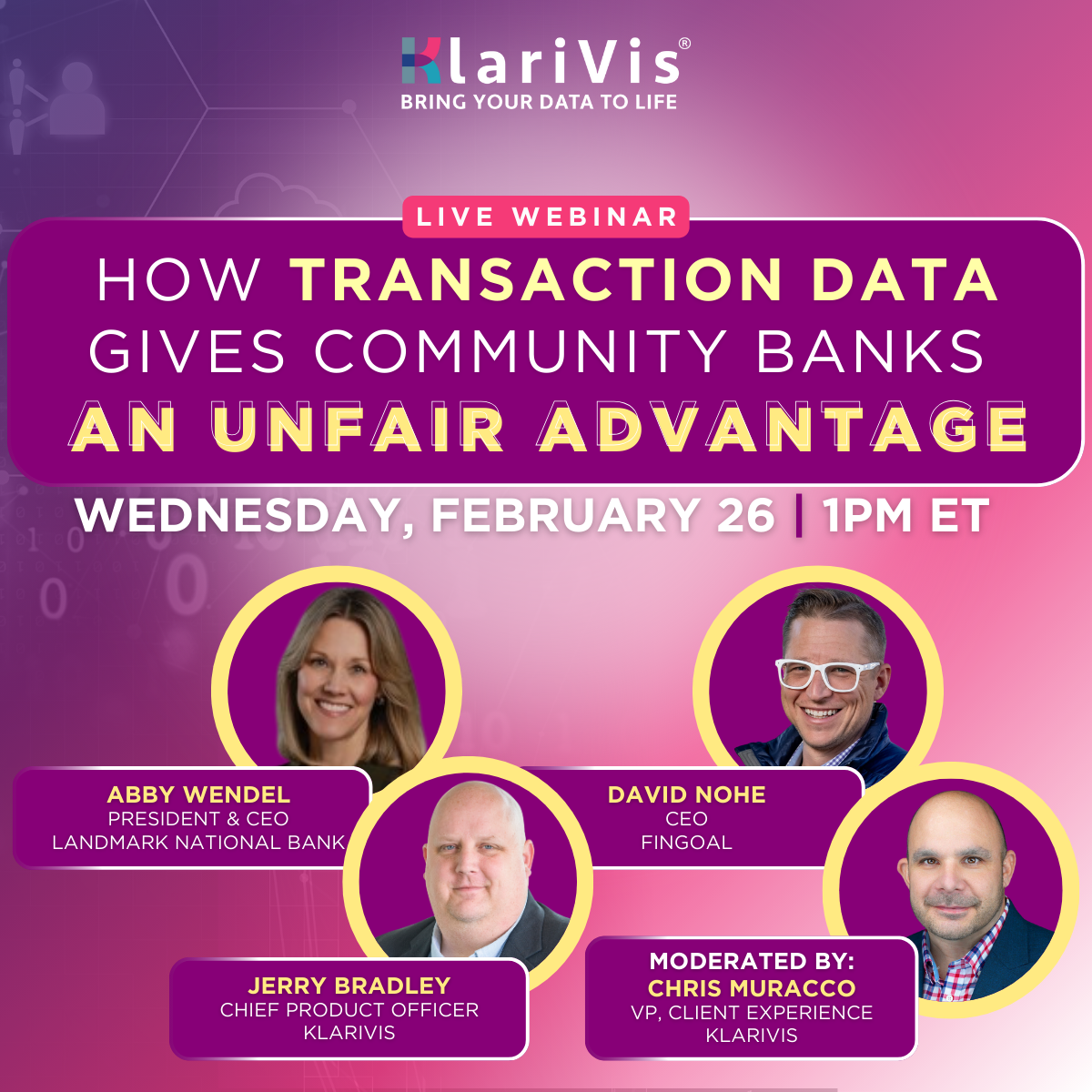

WEBINAR: How Transaction Data Gives Community Banks an Unfair Advantage

Every bank has transaction data – but few use it to their advantage. This discussion will equip you with actionable strategies to turn your bank’s transaction data into a competitive advantage.

Watch the Recording

Optimizing Data Strategy Through Resource Allocation

We’ve often seen that banks will try to add more to improve their data strategy after gaps are identified — more staff, more systems, more enhancements, more data. But doing so can be akin to putting a band-aid on a broken bone if they’re not focusing on the right problem.

Read Now